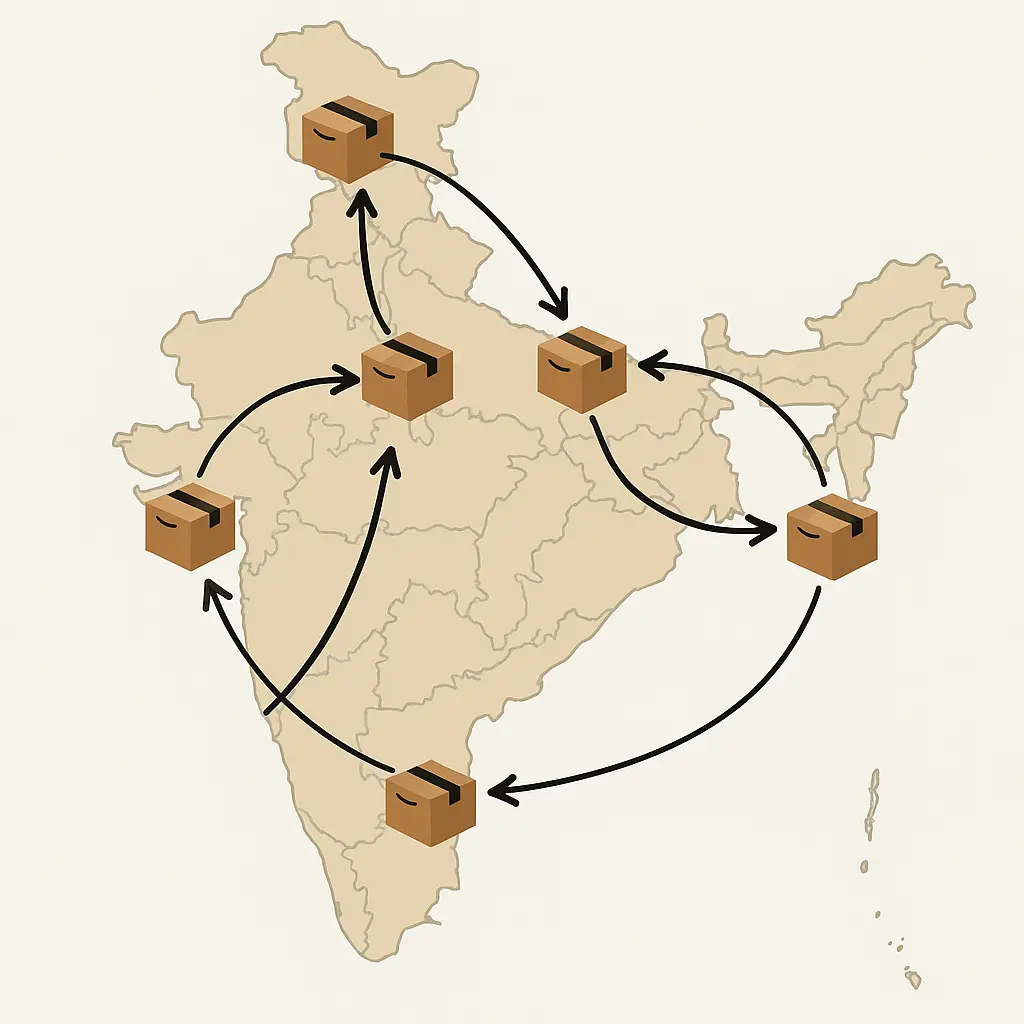

Amazon Inventory Placement (IXD) Program

Move your inventory seamlessly across India with Amazon’s IXD program. Let Ecomadarsh handle your registration, documentation, and compliance — so you can focus on sales.

GST Invoicing (Avail 18% ITC). Secure Payment Options Available. No Spam. No Sharing. 100% Confidentiality.

What is Amazon IXD?

✅ Moves inventory between Amazon Fulfilment Centres (FCs) across India.

✅ Simplifies shipment creation — only one shipment to the nearest Receive Centre.

✅ Reduces freight and operational costs.

✅ Keeps your inventory available for sale during transfers.

"Ecomadarsh helps sellers with APOB registration, VPOB documentation, and GST setup required to join IXD.”

GST Invoicing (Avail 18% ITC). Secure Payment Options Available. No Spam. No Sharing. 100% Confidentiality.

Key Benefits

Single Shipment:

No need to send to multiple FCs.

Lower Freight Costs:

Ship once, Amazon distributes

Simplified Compliance:

GST & APOB registration handled.

Amazon-Managed Transfers:

Less manual coordination.

Faster Inventory Reach:

Products available pan-India in 7 days.

Eligibility Checklist for Amazon IXD

|

Requirement |

Description |

|

✅ FBA Enrolled |

You must use Fulfilment by Amazon |

|

🏢 APOB in Receive Centre State |

Register Additional Place of Business (GST) |

|

🌍 GST in 2+ States |

For other IXD FC states |

|

📦 Regular Inbound to RC |

Must send stock to nearest Receive Centre |

"📞 Need help with your APOB or GST registrations? Contact Ecomadarsh to get it done for you.”

GST Invoicing (Avail 18% ITC). Secure Payment Options Available. No Spam. No Sharing. 100% Confidentiality.

Receive Centre Locations

| I am a Seller from: | Nearest Receive Centre | Destination Amazon Fulfilment Centres (IXD Fulfilment Centres) |

| Haryana / Delhi / West Bengal and other Northern states | DED3 or DEL8 (Haryana) | Local - [DEL4, DEL5] 14 Away cities - [AMD2, BLR7, BLR8, BOM5, BOM7, CCU1, CJB1, HYD3, HYD8, MAA4, PNQ3, SGAA, SJAC, LKO1] |

| Gujarat / Maharashtra / Madhya Pradesh | ISK3 (Maharashtra) | Local - [BOM5, BOM7, PNQ3] 14 away cities - [AMD2, BLR7, BLR8, CCU1, CJB1, DEL4, DEL5, HYD3, HYD8, LKO1, MAA4, SIDA, NAG1, JPX1] |

| Gujarat / Maharashtra / Madhya Pradesh | BOM6 (Maharashtra) | Local - [BOM5, BOM7, PNQ3] 13 away cities - [AMD2, BLR7, CJB1, CCU1, DEL4, DEL5, HYD3, HYD8, MAA4, BLR8, LKO1, SIDA, NAG1] |

| Karnataka / Telangana / Tamil Nadu / Andhra Pradesh / Kerala | BLR4 (Karnataka) | Local - [BLR7, BLR8] 13 Away cities - [AMD2, BOM5, BOM7, CCU1, CJB1, DEL4, DEL5, HYD3, HYD8, MAA4, PNQ3, SJAC, LKO1] |

"Ecomadarsh assists with registration and document submission for any of these locations.”

GST Invoicing (Avail 18% ITC). Secure Payment Options Available. No Spam. No Sharing. 100% Confidentiality.

Doocuments required for the Amazon IXD Program

|

Document |

Proprietorship |

Partnership |

Pvt. Ltd. |

|

PAN |

✅ |

✅ |

✅ |

|

Address Proof |

✅ |

✅ (Partner) |

✅ (Director) |

Photograph | ✅ | ✅ (Partner) | ✅ (Director) |

|

Cancelled Cheque |

✅ |

✅ |

✅ |

|

MOA/AOA/COI |

— |

— |

✅ |

Board Resolution | — | — | ✅ |

Authorized Signatory Letter | — | ✅ | ✅ |

Partnership Deed | — | ✅ | — |

"Ecomadarsh helps you prepare and file all documents for VPOB & APOB GST registration.”

GST Invoicing (Avail 18% ITC). Secure Payment Options Available. No Spam. No Sharing. 100% Confidentiality.

How Ecomadarsh Helps

Dive deeper into our company’s abilities.

01

Guidance for IXD eligibility

02

GST & APOB registration support

03

Documentation and filings

04

FBA warehouse compliance

05

Application assistance and tracking

"Apply for IXD via Ecomadarsh”

GST Invoicing (Avail 18% ITC). Secure Payment Options Available. No Spam. No Sharing. 100% Confidentiality.

Frequently Asked Questions

Amazon Inventory Placement (Ship Cross Dock or IXD) is a programme offered by Amazon Seller Services Private Limited (Amazon) to Sellers on www.amazon.in, that helps Sellers to move their inventory between different Fulfilment Centres (FCs) across the country, registered by the Seller as its respective Additional Place of Business in accordance with applicable laws. A Seller sends inventory to one of the nearest Receive Centres as mentioned in Table 1. A Receive Centre is a central Fulfilment Centre where the inventory is received and then transferred to other connected destination Amazon Fulfilment Centres.

No need to create multiple shipments - You do not have to create multiple shipments. You just have to create a single shipment for the nearest Receive Centre, thus potentially saving transportation costs to send your inventory to all the Fulfilment Centres where you are registered. No need to make multiple appointments - You do not need to make multiple appointments across Fulfilment Centres where you are registered. You just need a single appointment at the nearest Receive Centre. Save on freight and operational costs - You are only charged a single Shipping Fee for Customer shipments shipped from Fulfilment Centres across India, resulting in potential savings on freight and operational costs.

Any Seller who uses Fulfilment by Amazon services subject to the Amazon Services Business Solutions Agreement and the terms and conditions of the IXD programme, can enrol in the IXD programme. The Seller must have: Additional Place of Business (APOB) registration as per applicable laws, for the nearest (as per home cluster of the Seller) Receive Centre’s state and must have GST registration in the respective default local FULFILMENT CENTRE of the state (please refer to Table 1). GST registration for at least two other states other than the home state and APOB in IXD Amazon Fulfilment Centres in these states (please refer to Table 1).

Yes, the list of Receive Centres and destination FCs is subject to change based on Customer demand. Any update will be communicated to the participating Sellers, after which the Sellers will have an option to opt out of the IXD programme as per the terms and conditions.

It is always recommended for Sellers to send inventory to the nearest Receive Centre to potentially save on transportation costs. However, if the nearest Receive Centre has space constraints, then Sellers can choose to send stocks to other Receive Centres. Sellers belonging to states that do not have a Receive Centre (RC) can send their stocks to any Receive Centre that is easily accessible.

All Customer returns will be sent to the “point of invoicing” or to the nearest return consolidation centre. Customer return is delivered to the Amazon FCs from where the Customer order was invoiced and shipped, or to nearest return consolidation centre if the Seller has opted for the Return Consolidation programme.

"Join Amazon IXD with Confidence — Ecomadarsh Makes It Simple.”

GST Invoicing (Avail 18% ITC). Secure Payment Options Available. No Spam. No Sharing. 100% Confidentiality.

What are the documents required for the Amazon IXD Program?

There are no specific documents that are required, but to be eligible for this program, you need to get VPOB GST registered in receiving center states and other additional states. Below are the required documents for VPOB GST registration.

| Nature of Document | Proprietorship | Partnership | Private Limited |

| PAN | Yes | Yes | Yes |

| Address Proof | Yes | Yes (of Partner) | Yes (of Director) |

| Photograph | Yes | Yes (of Partner) | Yes (of Director) |

| Cancelled Cheque | Yes | Yes | Yes |

| MOA, AOA, COI | No | No | Yes |

| Board Resolution | No | No | Yes |

| Authorised Signatory Letter | No | Yes | Yes |

| Partnership Deed | No | Yes | No |